News & Updates

Blog

2025-05-30

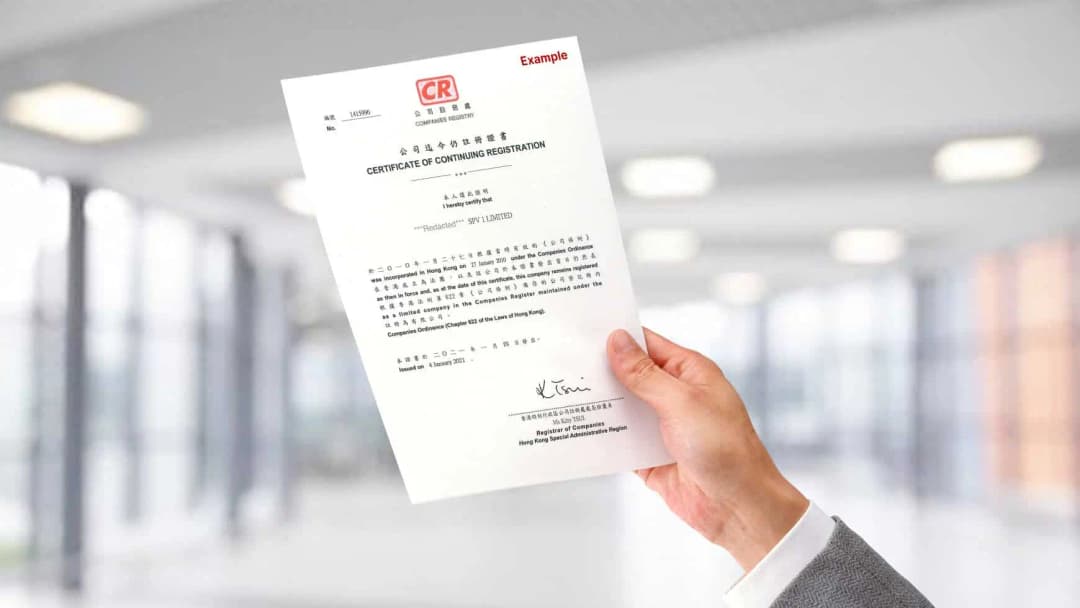

[2023 Latest] Complete Guide for Mainland Chinese to Set Up a Company in Hong Kong — Procedures, Costs, and Considerations

A comprehensive guide for mainland entrepreneurs to set up a company in Hong Kong, detailing registration procedures, bank account opening, tax planning, and cross-border business arrangements to help you enter the international market smoothly.

2025-05-29

Hong Kong Companies and Mainland China Taxation: Key Considerations and Best Practices for Legal Tax Optimization

Explores how mainland entrepreneurs can legally optimize taxes through Hong Kong companies, detailing differences in tax systems, application of tax treaties, considerations regarding the place of effective management, and transfer pricing regulations to achieve tax optimization on a compliant basis.

2025-05-28

Advanced Guide to Cross-Border E-Commerce: How to Efficiently Utilize a Hong Kong Company for International Trade

Explore the complete guide on how to utilize a Hong Kong company for cross-border trade. Learn about Hong Kong's tax advantages, trade processes, e-commerce platform integration, and the latest policy trends to help your cross-border e-commerce business soar.

2025-05-27

Advantages of Hong Kong Family Offices: An Ideal Choice for Mainland Investors | Taxation, Asset Management, and Global Deployment

Explore the key advantages for mainland investors in establishing family offices in Hong Kong, including the tax environment, financial infrastructure, legal system, professional services, and asset succession planning, helping high-net-worth individuals achieve global asset allocation and wealth succession.

2025-05-26

Hong Kong and Mainland China Bank Account Linkage Management Strategies: An Essential Guide for Cross-Border Entrepreneurs

Explore how mainland entrepreneurs can efficiently manage bank accounts in Hong Kong and the mainland, solve cross-border fund flow challenges, and achieve business expansion. Includes practical linkage strategies, compliance guidelines, and success cases.

2025-05-14

Cross-Border E-Commerce Tax Planning: How Hong Kong Companies Can Optimize Your Global Business Layout

Learn how Hong Kong companies play a key role in cross-border e-commerce tax planning, leveraging the territorial source principle, low tax rates, and an extensive tax treaty network to optimize your global business layout and tax structure.

2025-05-13

New Trends in Cross-Border E-Commerce: The Strategic Advantages and Practical Applications of Hong Kong Bonded Warehouses

Explore how Hong Kong bonded warehouses serve as a strategic advantage for cross-border e-commerce, including key factors such as tax benefits, geographical location, and efficient logistics, helping e-commerce sellers optimize inventory management and expand into global markets.

2025-05-12

Digital Nomad Entrepreneur: How to Successfully Manage a Hong Kong Company Remotely [Real Case Study]

Explore real case studies of how digital nomads successfully manage Hong Kong companies remotely. From company registration and virtual offices to tax compliance, gain a comprehensive understanding of the challenges and solutions for remote entrepreneurs.

2025-05-09

From Freelancer to Formal Business: A Designer's Compliance Transformation Story | Real Case of Hong Kong Company Registration

Learn how a Hong Kong designer successfully transitioned from freelancer to formal company with Chinglink's assistance, gaining tax advantages, enhancing professional image, and achieving 38% business growth in this real case study.