News & Updates

Blog

2025-05-08

Digital Nomad Guide: How to Establish a Legal Global Business Identity with a Hong Kong Company

Want to become a digital nomad while maintaining a legitimate business identity? Learn how to leverage the advantages of Hong Kong company registration to establish an internationally recognized business identity, enjoy tax benefits, and gain global business credibility. A must-read comprehensive guide for freelancers!

2025-05-07

[2025 Latest] Comprehensive Comparison of Cross-Border E-commerce Digital Payment Solutions in Hong Kong: Stripe, PayPal, Alipay HK, and More

2024 comprehensive comparison of cross-border e-commerce digital payment solutions in Hong Kong: Analysis of the pros, cons, fees, and applicable scenarios of major payment platforms like Stripe, PayPal, Alipay HK, and WeChat Pay to help e-commerce sellers choose the most suitable payment solution.

2025-05-06

Hong Kong E-commerce Company Structure: Best Practices Guide for Cross-border Sellers' Global Expansion

Explore how Hong Kong e-commerce company structures create global business advantages for cross-border sellers. Learn about tax optimization, multi-platform operations, cash flow planning, and practical case studies to help you establish the best global e-commerce framework.

2025-05-02

Complete Guide to Hong Kong Profits Tax Filing: Common Mistakes and How to Avoid Them

This guide details the Hong Kong profits tax filing process, revealing common mistakes and professional avoidance methods. Suitable for Hong Kong business owners to learn how to comply with tax regulations and optimize tax filings.

2025-04-30

Comprehensive Analysis of Hong Kong Tax Incentive Policies: How Startups Can Legally Reduce Tax Burden

A must-read for Hong Kong startups! In-depth analysis of Hong Kong's tax incentive policies, including the two-tiered profits tax system, R&D expenditure deductions, offshore tax strategies, and more, helping you legally reduce taxes, optimize financial structures, and make your entrepreneurial journey smoother.

2025-04-29

Hong Kong's Global Tax Treaties: A Complete Guide for Multinational Companies to Avoid Double Taxation

Learn how Hong Kong's global tax treaties help multinational companies avoid double taxation, reduce tax costs, and optimize global tax structures, including practical case studies and tax planning strategies.

2025-04-28

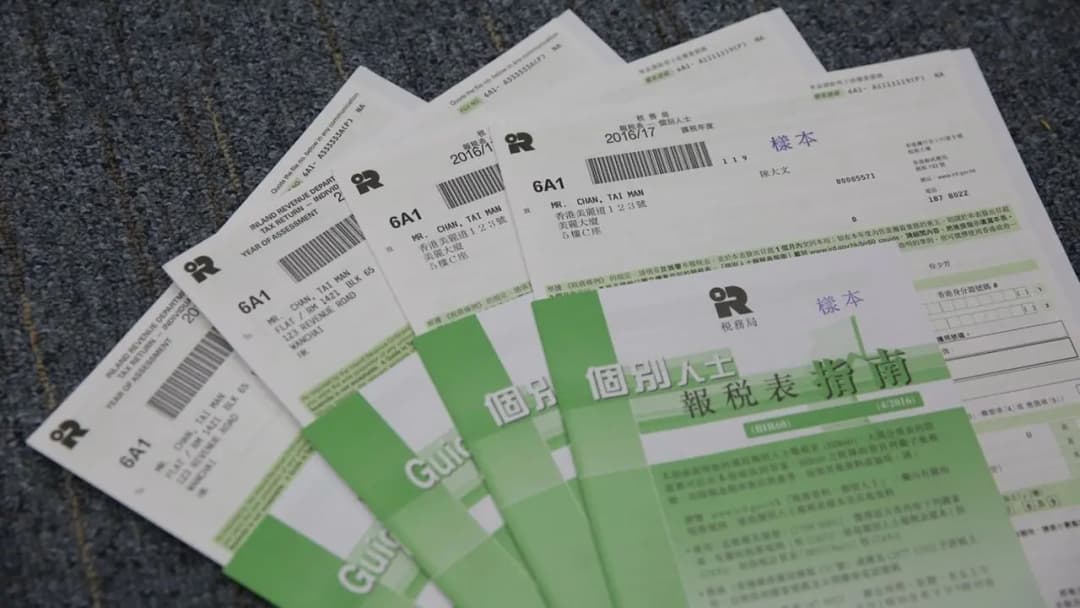

Hong Kong Inland Revenue Department Tax Assessment Objection and Appeal: A Complete Guide to Corporate Rights Protection

Learn the complete process for objecting to and appealing tax assessments by the Hong Kong Inland Revenue Department. Master corporate tax rights protection techniques, avoid common pitfalls, and ensure your company's tax rights are reasonably safeguarded.

2025-04-22

Startup Tax Planning: A Comprehensive Strategy Guide from Establishment to Profitability

A comprehensive tax planning guide for Hong Kong startups from establishment to profitability, covering key topics such as business structure selection, R&D tax incentives, cross-border tax strategies, and more to help legally reduce taxes and optimize cash flow

2025-04-21

Hong Kong Individual vs Corporate Taxation Comparison: How Self-Employed and Limited Companies Can Choose the Best Tax Structure

An in-depth comparison of tax differences between self-employed individuals and limited companies in Hong Kong, helping freelancers and independent contractors choose the best tax structure, save taxes and enhance business efficiency. Includes case analysis and professional tax strategies.